Westpac Verify

Checks the account details and names match, to help you pay the right person. Another layer of scam and fraud defence.

Coming soon

We'll soon be enhancing Westpac Verify to include Confirmation of Payee. Confirmation of Payee is a name matching service created by Australian Payments Plus and the Australian Banking Association, to help complete further checks when adding or changing a payee using BSB and Account number.

What is Westpac Verify?

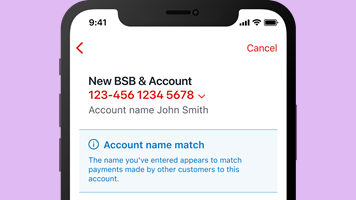

When adding a new payee, to a BSB and account number, we’ll do a check to see if the account details you’ve entered have been commonly used, based on the history of other payments made within Westpac.

We’ll soon integrate Confirmation of Payee into Westpac Verify. This means we will also check the account details you’ve entered against the details held at the payee's bank.

The additional check helps provide you another layer of protection - we’ll display a match outcome to help protect you from mistaken payments and Payment Redirection or Business Email Compromise scams.

What will I see

Important:

You can still proceed with a payment in any of these scenarios. To be sure though, always speak to the payee first to confirm the account details, as it could be a new account or there may be a typo. You may not get your money back if you pay the wrong person or if it's a scam.

Want to bank with layers of defence?

Build your defence when adding new payees with Westpac Verify - designed to reduce mistaken payments and help avoid potential scam accounts.

Frequently Asked Questions

Westpac Verify is designed to help prevent payments to incorrect account details and helps protect you from payment redirection scams or mistaken payments.

Payment redirection scams, sometimes called business email compromise scams, occur when scammers send emails or messages asking you to send money to new or updated payee details.

Mistaken payments can occur when you enter incorrect details.

You don’t need to activate this feature, it’s available when adding a new BSB and account number payee.

We’ll check to see if the account details you’ve entered have been commonly used, based on payment history within Westpac.

Until Confirmation of Payee is introduced, we're unable to validate the account details with recipient banks, so we can’t confirm whether the name and account details are an exact match.

Westpac Verify will check the account name used for other payments we've seen made to the BSB and account number entered. We’ll let you know if the account name you've entered is not commonly used.

Commonly shortened names, e.g., Chris or Ben, will be taken into consideration when providing you an outcome.

If you are concerned about an existing payee, you are able to verify the details for that payee by simply clicking 'edit payee', through Desktop or Mobile Browser banking. You do not need to edit details, just click 'Check Details'.

No, Westpac Verify is not available on imported files.

Westpac Verify will only display for the user who creates or edits a BSB and account payee. If a payee or payment requires multiple approvers, Westpac Verify will not be displayed to each of the authorising users, only the creator of the payee.

Westpac Verify will check the account name used for other payments we've seen made to the BSB and account number entered. Responses may not take into account where the account is established to accept payments in another name, e.g. the account owner has a registered trading name or trust account.

In these instances, if you have contacted the account owner and verbally confirmed that the payment details are correct, this should provide some confidence in continuing with the payment.

In some cases, eligible individual and sole trader customers can request to opt out of Confirmation of Payee by contacting us or visiting us in branch. You can find your nearest branch at westpac.com.au/locateus.

When opted out, your account name won’t be shown to payers during verification and may lower the payer’s confidence which could impact their decision to proceed with the payment.

Important: Opting out does not apply to certain payments from government agencies, such as welfare or emergency support payments.

You can request to opt back in to sharing your details with the Confirmation of Payee service any time.

Things you should know

We will be enhancing Westpac Verify to include Confirmation of Payee, an initiative of Australian Payments Plus. Confirmation of Payee is a name matching service to help conduct further checks when adding or amending a payee using BSB and Account number. Westpac does not currently provide Confirmation of Payee service. Verify with Confirmation of Payee Terms & Conditions (PDF 109KB) apply.

* The Digital Card is only available in the Westpac App and supported with the latest version of the Westpac App. The terms and conditions applicable to your product also apply to the use of your digital card. Online Banking Terms & Conditions also apply. You may not always be able to access your digital card.

Westpac Verify screening is based on the payment information available in our systems, at the time you add or edit your payee details. As we are unable to validate the account details with the recipient bank, we can’t confirm whether the name and account details are an exact match.

Westpac Verify applies to Westpac Online Banking and our Mobile App only. It may be affected by such things as system outages or limitations, scheduled maintenance or other factors beyond our control, and may not be available at all times.

If your Westpac account is compromised as a result of online fraud, we guarantee to repay any missing funds, providing you comply with our Westpac Online Banking Terms and Conditions. This includes keeping your sign-in details (including passwords, Westpac Protect™ SMS codes and SecurID® Token codes) private. You must inform us immediately if you suspect the security of your access details has been compromised, or you suspect an unauthorised transaction or potential fraud on your accounts. Please refer to the Westpac Online Banking Terms and Conditions (PDF 408KB).